Home Office Use Hmrc . for example, if you deduct repairs and renewals, there needs to be evidence of the money actually spent by you. Calculate your rent, mortgage, and bills,. use a simpler calculation to work out income tax for your vehicle, home and business premises expenses use of home as office calculator: As an employer providing homeworking expenses for your employees, you have certain tax, national insurance. How much to claim as a tax deductible expense for working for home. the easiest way to calculate your home office expenses is to use hmrc’s published allowance for the additional costs of running your. hmrc guidance around using your home as an office tax relief (working from home) claim your limited company.

from www.brightpay.co.uk

for example, if you deduct repairs and renewals, there needs to be evidence of the money actually spent by you. use a simpler calculation to work out income tax for your vehicle, home and business premises expenses hmrc guidance around using your home as an office tax relief (working from home) claim your limited company. As an employer providing homeworking expenses for your employees, you have certain tax, national insurance. the easiest way to calculate your home office expenses is to use hmrc’s published allowance for the additional costs of running your. use of home as office calculator: How much to claim as a tax deductible expense for working for home. Calculate your rent, mortgage, and bills,.

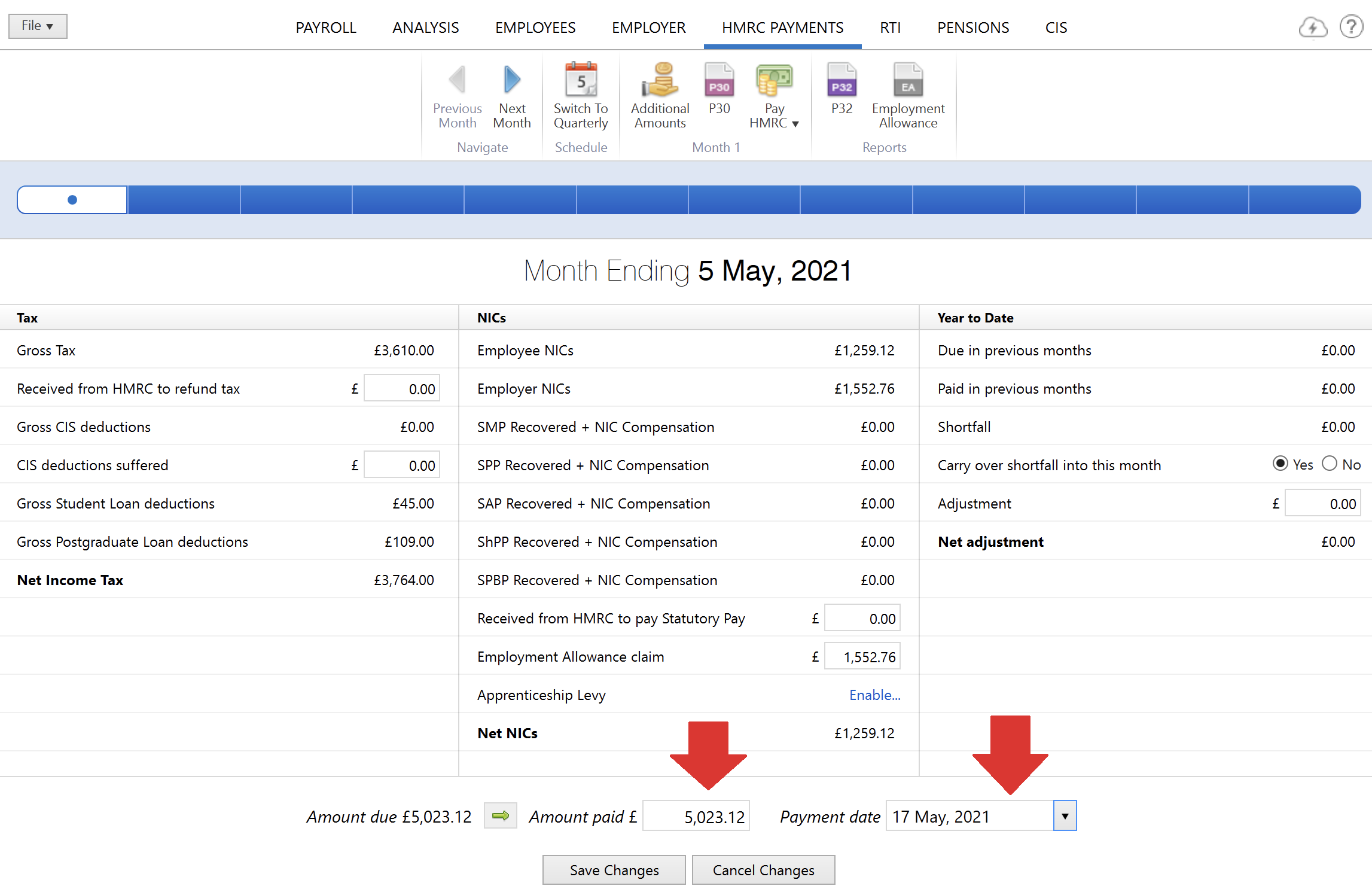

Paying HMRC using Modulr BrightPay Documentation

Home Office Use Hmrc As an employer providing homeworking expenses for your employees, you have certain tax, national insurance. As an employer providing homeworking expenses for your employees, you have certain tax, national insurance. use a simpler calculation to work out income tax for your vehicle, home and business premises expenses Calculate your rent, mortgage, and bills,. hmrc guidance around using your home as an office tax relief (working from home) claim your limited company. the easiest way to calculate your home office expenses is to use hmrc’s published allowance for the additional costs of running your. How much to claim as a tax deductible expense for working for home. for example, if you deduct repairs and renewals, there needs to be evidence of the money actually spent by you. use of home as office calculator:

From www.1stformations.co.uk

What is a registered office address? Home Office Use Hmrc hmrc guidance around using your home as an office tax relief (working from home) claim your limited company. Calculate your rent, mortgage, and bills,. the easiest way to calculate your home office expenses is to use hmrc’s published allowance for the additional costs of running your. for example, if you deduct repairs and renewals, there needs to. Home Office Use Hmrc.

From www.alterledger.com

Making Tax Digital for VAT why have HMRC sent a letter? Alterledger Home Office Use Hmrc As an employer providing homeworking expenses for your employees, you have certain tax, national insurance. hmrc guidance around using your home as an office tax relief (working from home) claim your limited company. use a simpler calculation to work out income tax for your vehicle, home and business premises expenses the easiest way to calculate your home. Home Office Use Hmrc.

From www.pinterest.com

Ward Robinson Interior Design Newcastle Upon Tyne HMRC Office Design Breakout BPV Home Office Use Hmrc use a simpler calculation to work out income tax for your vehicle, home and business premises expenses use of home as office calculator: the easiest way to calculate your home office expenses is to use hmrc’s published allowance for the additional costs of running your. hmrc guidance around using your home as an office tax relief. Home Office Use Hmrc.

From studyingthebnp.blogspot.com

HMRCLEAKS Blog of a Civil Service whistleblower in Her Majesty's Revenue and Customs HMRC Home Office Use Hmrc for example, if you deduct repairs and renewals, there needs to be evidence of the money actually spent by you. As an employer providing homeworking expenses for your employees, you have certain tax, national insurance. How much to claim as a tax deductible expense for working for home. use of home as office calculator: use a simpler. Home Office Use Hmrc.

From www.techradar.com

How to keep your home office secure TechRadar Home Office Use Hmrc Calculate your rent, mortgage, and bills,. for example, if you deduct repairs and renewals, there needs to be evidence of the money actually spent by you. use of home as office calculator: the easiest way to calculate your home office expenses is to use hmrc’s published allowance for the additional costs of running your. use a. Home Office Use Hmrc.

From www.spondoo.co.uk

HMRC'S SUPER DEDUCTION CAN I CLAIM MY FURNITURE FOR MY HOME OFFICE? Home Office Use Hmrc use of home as office calculator: use a simpler calculation to work out income tax for your vehicle, home and business premises expenses As an employer providing homeworking expenses for your employees, you have certain tax, national insurance. the easiest way to calculate your home office expenses is to use hmrc’s published allowance for the additional costs. Home Office Use Hmrc.

From businessadviceservices.co.uk

Sample HMRC Letters Business Advice Services Home Office Use Hmrc use a simpler calculation to work out income tax for your vehicle, home and business premises expenses How much to claim as a tax deductible expense for working for home. the easiest way to calculate your home office expenses is to use hmrc’s published allowance for the additional costs of running your. use of home as office. Home Office Use Hmrc.

From howigotjob.com

HMRC Office Locations And Headquarters Home Office Use Hmrc for example, if you deduct repairs and renewals, there needs to be evidence of the money actually spent by you. use of home as office calculator: Calculate your rent, mortgage, and bills,. How much to claim as a tax deductible expense for working for home. hmrc guidance around using your home as an office tax relief (working. Home Office Use Hmrc.

From mileiq.com

The HMRC Home Office Tax Deduction Rules MileIQ Home Office Use Hmrc Calculate your rent, mortgage, and bills,. for example, if you deduct repairs and renewals, there needs to be evidence of the money actually spent by you. use a simpler calculation to work out income tax for your vehicle, home and business premises expenses the easiest way to calculate your home office expenses is to use hmrc’s published. Home Office Use Hmrc.

From rjf.uk.com

Claiming for a Home Office What Do HMRC Allow? Home Office Use Hmrc use a simpler calculation to work out income tax for your vehicle, home and business premises expenses How much to claim as a tax deductible expense for working for home. the easiest way to calculate your home office expenses is to use hmrc’s published allowance for the additional costs of running your. use of home as office. Home Office Use Hmrc.

From www.alamy.com

steps and entrance to India buildings commercial building home to regional office of hmrc Home Office Use Hmrc hmrc guidance around using your home as an office tax relief (working from home) claim your limited company. use a simpler calculation to work out income tax for your vehicle, home and business premises expenses the easiest way to calculate your home office expenses is to use hmrc’s published allowance for the additional costs of running your.. Home Office Use Hmrc.

From www.desertcart.no

Buy Tribesigns Computer Desk 55 inch Folding Office Desk Table Workstation No Assembly Required Home Office Use Hmrc use of home as office calculator: use a simpler calculation to work out income tax for your vehicle, home and business premises expenses hmrc guidance around using your home as an office tax relief (working from home) claim your limited company. the easiest way to calculate your home office expenses is to use hmrc’s published allowance. Home Office Use Hmrc.

From www.tftconsultants.com

HMRC Stratford hub celebrates topping out ceremony before it home to Brexit preparations Home Office Use Hmrc Calculate your rent, mortgage, and bills,. the easiest way to calculate your home office expenses is to use hmrc’s published allowance for the additional costs of running your. use a simpler calculation to work out income tax for your vehicle, home and business premises expenses use of home as office calculator: How much to claim as a. Home Office Use Hmrc.

From www.brightpay.co.uk

Paying HMRC using Modulr BrightPay Documentation Home Office Use Hmrc Calculate your rent, mortgage, and bills,. hmrc guidance around using your home as an office tax relief (working from home) claim your limited company. for example, if you deduct repairs and renewals, there needs to be evidence of the money actually spent by you. As an employer providing homeworking expenses for your employees, you have certain tax, national. Home Office Use Hmrc.

From nfsp.org.uk

Post Office card account (POca) customer extension announced by HMRC Home Office Use Hmrc use of home as office calculator: How much to claim as a tax deductible expense for working for home. As an employer providing homeworking expenses for your employees, you have certain tax, national insurance. use a simpler calculation to work out income tax for your vehicle, home and business premises expenses Calculate your rent, mortgage, and bills,. . Home Office Use Hmrc.

From www.civilserviceworld.com

HMRC, Home Office, and DWP to share data in ‘fully digital’ postBrexit immigration system Home Office Use Hmrc hmrc guidance around using your home as an office tax relief (working from home) claim your limited company. for example, if you deduct repairs and renewals, there needs to be evidence of the money actually spent by you. use of home as office calculator: How much to claim as a tax deductible expense for working for home.. Home Office Use Hmrc.

From logo-marque.com

HMRC Logo histoire, signification de l'emblème Home Office Use Hmrc the easiest way to calculate your home office expenses is to use hmrc’s published allowance for the additional costs of running your. for example, if you deduct repairs and renewals, there needs to be evidence of the money actually spent by you. As an employer providing homeworking expenses for your employees, you have certain tax, national insurance. . Home Office Use Hmrc.

From studyingthebnp.blogspot.com

HMRCLEAKS Blog of a Civil Service whistleblower in Her Majesty's Revenue and Customs HMRC HMRC Home Office Use Hmrc the easiest way to calculate your home office expenses is to use hmrc’s published allowance for the additional costs of running your. As an employer providing homeworking expenses for your employees, you have certain tax, national insurance. hmrc guidance around using your home as an office tax relief (working from home) claim your limited company. use of. Home Office Use Hmrc.